Wednesday, 15th November, 2023

Financial Accounting 2 (Theory and Practice) – 9:30am – 12noon

Financial Accounting 1 (Objective) – 12noon – 1:00pm

A. 2023 WAEC GCE FINANCIAL ACCOUNTING OBJECTIVE (OBJ) ANSWERS | 15TH NOVEMBER, 2023

1-10: CBADCBBBBA11-20: ABBABCDDDC

21-30: BBCBBBBABB

31-40: DDCDCDDCBD

41-50: CBCACBCDCB

B. 2023 WAEC GCE FINANCIAL ACCOUNTING ESSAY (THEORY) ANSWERS | 15TH NOVEMBER, 2023

(1a)

(PICK ANY THREE)

(i) Purchase of goods for resale

(ii) Receiving goods as a gift or donation

(iii) Return of goods purchased from suppliers

(iv) Transfer of goods from one location to another within the company

(v) Manufacturing or producing goods

(iv) Conversion of raw materials into finished goods

(1b)

Goodwill

is an intangible asset that represents the reputation, customer

loyalty, and brand value of a business. It is an asset that is not

easily measurable or physically quantifiable but can have a significant

impact on the value and success of a business. Goodwill is associated

with qualities such as trust, customer satisfaction, and positive

relationships with stakeholders.

(1c)

(i) Water charges paid: Utility bill or receipt from the water company

(ii) Credit sales: Sales invoice or sales receipt

(iii) Credit purchases: Purchase invoice or purchase receipt

(iv) Wages: Payroll record or wage slip

(V) Cash payment: Cash receipt or payment voucher

(vi) Electricity owed: Utility bill or invoice from the electricity provider

(vii) Returns by customers: Sales return slip or return receipt

(viii) Returns to suppliers: Purchase return slip or return receipt

(ix) Cheque deposit: Deposit slip or bank statement

(x) Dishonoured cheque: Bank statement or notification from the bank indicating the dishonored cheque.

(2a)

A

manufacturing account is a financial statement that summarizes the

costs incurred in the production of goods during a specific accounting

period. It includes direct and indirect costs associated with

manufacturing, such as raw materials, labor, and factory overhead. The

purpose of the manufacturing account is to calculate the total

manufacturing cost and determine the cost of goods produced.

(2b)

(i) Direct materials

(ii) Direct labor

(iii) Direct expenses

(2c)

(i)

Prime cost: It refers to the total cost of direct materials, direct

labor, and direct expenses. It represents the main components of the

production cost.

(ii) Factory overhead: Also known as indirect

costs, factory overhead includes all the expenses incurred in the

production process that are not directly attributable to specific units.

It includes costs like rent, utilities, depreciation, and maintenance.

(iii)

Work-in-progress: Work-in-progress (WIP) refers to goods that are in

the process of being manufactured but are not yet finished. It

represents the value of partially completed products at a specific point

in time.

(iv) Finished goods: Finished goods are the completed

products that are ready for sale to customers. They have gone through

the entire manufacturing process and are in their final form.

(v)

Market value of goods produced: The market value of goods produced

refers to the estimated selling price of the finished goods at the time

they are produced. It represents the value of the goods based on market

demand and other factors.

(3a)

Bad debt refers to money

that is owed to a company or individual but is unlikely to be paid back.

It's basically a debt that becomes uncollectible.

(3b)

(i) When the debtor declares bankruptcy and has no assets to repay the debt.

(ii) When the debtor is untraceable or cannot be contacted.

(iii) When the debt is too small to pursue legally or the cost of recovery outweighs the debt.

(iv) When the debtor has passed away and there are no assets to settle the debt.

(v) When the debtor refuses to pay and there is no legal recourse available.

(3c)

(i)

Bad debts are specific debts that have been identified as

uncollectible, while provision for doubtful debts is an estimated amount

set aside to cover potential bad debts.

(ii) Bad debts are written

off when they are deemed uncollectible, while provision for doubtful

debts remains as a reserve on the balance sheet.

(iii) Bad debts

directly impact the profit and loss statement, reducing the company's

net income, while provision for doubtful debts affects the balance sheet

by reducing the accounts receivable balance.

(iv) Bad debts are

recognized after attempts to collect the debt have been made, while

provision for doubtful debts is recognized as a precautionary measure

before any specific debts are identified as uncollectible.

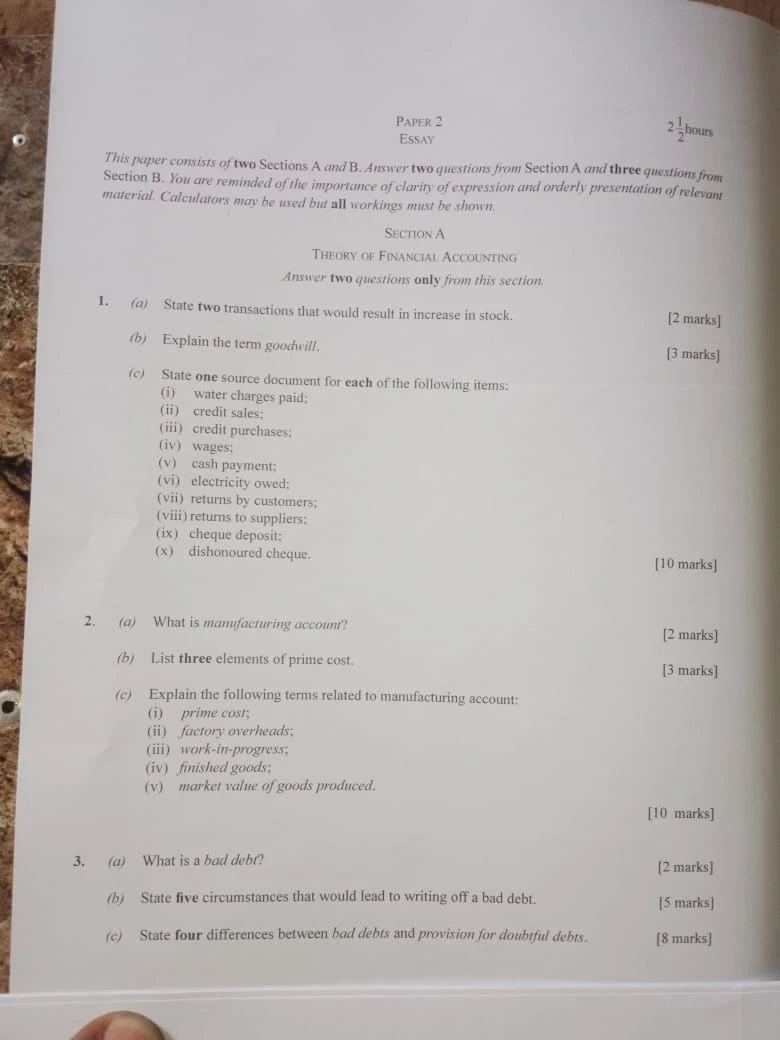

C. 2023 WAEC GCE FINANCIAL ACCOUNTING ESSAY QUESTIONS

- JUST GO OUT AND BUY MTN CARDS OF N600 (500 + 100 = 600)

- GO TO YOUR MESSAGE, TYPE THE MTN CARD PINS CORRECTLY AND SEND TO 08107431933.

- DON'T CALL THE NUMBER, JUST TEXT, IF THE CARDS PINS ARE VALID, A REPLY WILL BE SENT TO YOU CONFIRMING THAT YOU HAVE BEEN SUBSCRIBED.

- DO

NOT TRY TO LOAD THE CARD AFTER SENDING AND NO REPLY WAS SENT

IMMEDIATELY, BE PATIENT AS WE ATTEND TO MESSAGES IN ASCENDING ORDER

- RELAX AND WAIT FOR YOUR ANSWERS 45 MINUTES AFTER EXAM STARTS.

- NB: DO NOT SEND USED CARD PINS OR YOUR NUMBER WILL BE BLOCKED IMMEDIATELY.

===============================================

DAILY SUBSCRIPTION - PER SUBJECTS

*******Link Payment Per Subject: N600***** [Gets Answers On Time]

******Link Payment Per Practical: N400***** [Gets Answers On Time]

===========================================

![2023 WAEC GCE Financial Accounting Answers [15th November] 2023 WAEC GCE Financial Accounting Answers [15th November]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiLpscRHYGoWjC54apNFuIz-yhLLkJa7JYNKm-bGzVBIFKqRLUKtsYzx24uyL2HqYLD8_Gop6S7SNQnBl6sjqL31487MAh7b7Kx1n3XaPN3l54vSZn-TETFEKzXg8KVxdTQ44CDoUMgLDI/w302-h320-rw/WAEC+LOGO.png)

1 Comments

Number 1

ReplyDeleteNOTE: Comments are moderated and may not appear immediately as they require review and approval by a moderator. Remember to check the "Notify Me" box before submitting your comment to receive notifications when your comment is approved or when a reply is posted.